REAL-TIME ACCESS TO COMPARABLE IMPACT DATA ON COMPANY HOLDINGS

Portfolio Tracker delivers an end-to-end digital solution where all stakeholders, companies (large, SMEs, private and public), standard setters, and investors are on one interoperable platform, effectively communicating in a standardised way for strategic decision making.

Know where to invest, divest, manage risk and create sustainable solutions with one golden source of real-time data.

PORTFOLIO TRACKER EMPOWERS YOU TO:

✓ Data collection directly from any size portfolio companies via Company Tracker, with training, education and user support, and couriers the data to Portfolio Tracker members in real-time. Suitable for Stock Exchanges, Fis, Regulators and MNCs for supply chain tracking and procurement.

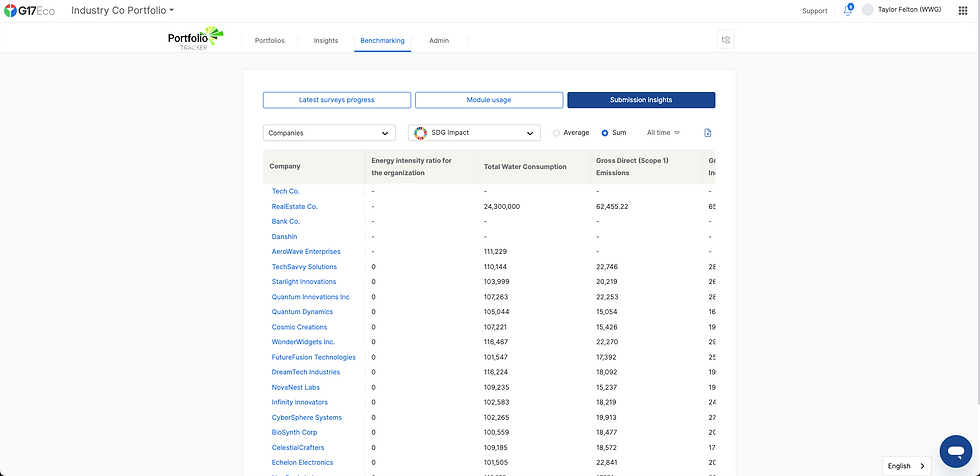

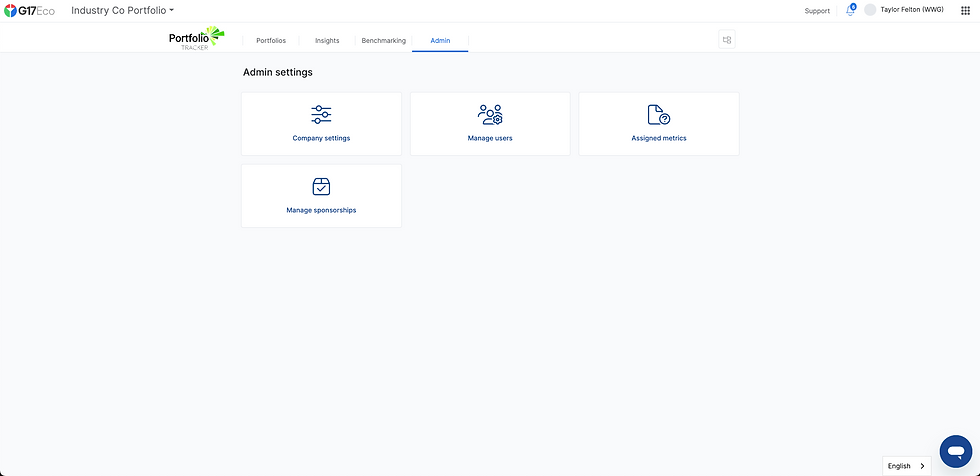

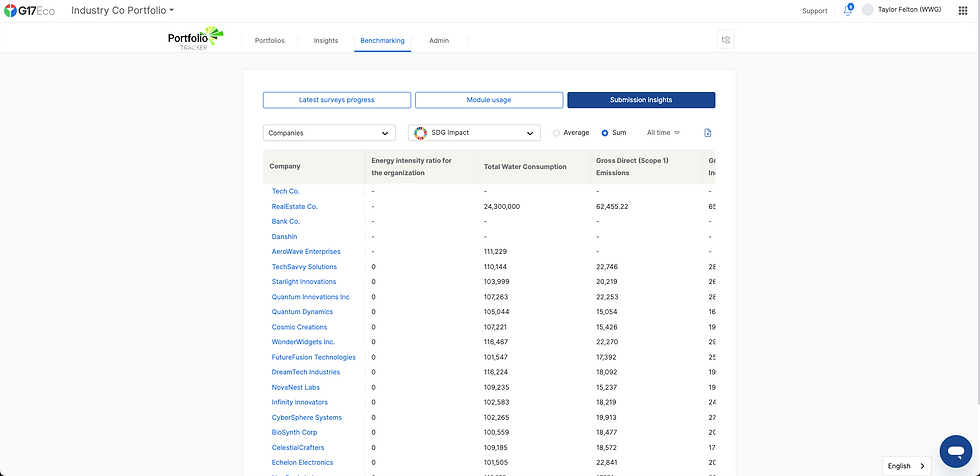

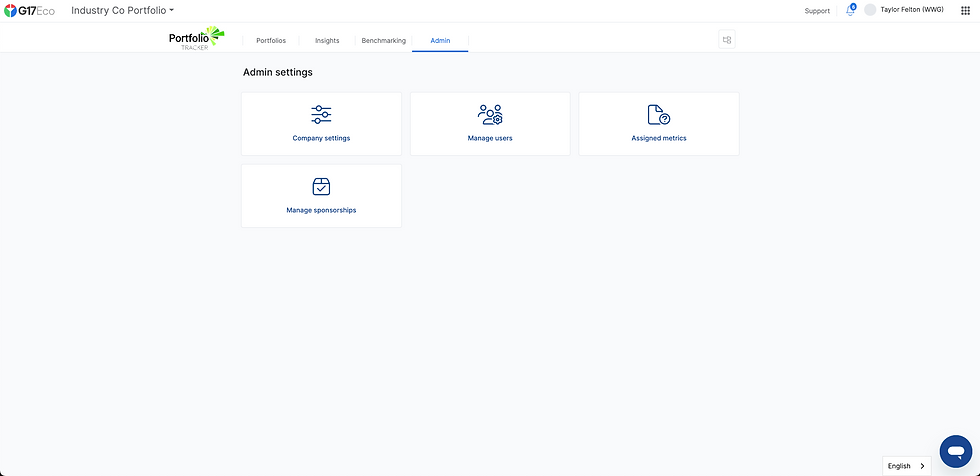

✓ Portfolio Tracker Members can track disclosure progress, self-serve by adding more metrics, questionnaires and more Companies to the Portfolio Tracker.

✓ All data records have an immutable and fully traceable chain of provenance and evidence and can handle qualitatives and quantitative data, with filtering and benchmarking capabilities.

✓ Data and reports can be provided via dashboards, CSV or API in real-time once published.

✓ Create actual, thematic and virtual portfolios and analytics to gain rapid insights.

FREQUENTLY ASKED

What is Portfolio Tracker and how does it work?

Portfolio Tracker is an end-to-end digital solution within the G17Eco platform that provides real-time access to comparable impact data on company holdings. It allows all stakeholders, including companies, investors, and standard setters, to communicate in a standardised way. Users can nominate portfolio companies for training and onboarding, collect real-time data with immutable provenance, and categorise this data by territory and value chain to inform strategic decision-making.

What are the benefits of using Portfolio Tracker for investors?

Investors benefit from a single, reliable source of real-time data that helps them identify where to invest, divest, and manage risks. The Portfolio Tracker allows for the calculation of companies’ contributions to the Sustainable Development Goals (SDGs) and offers a comprehensive dashboard that aggregates assurance and rating opinions. This enables investors to make informed decisions based on actual impact data, helping to create sustainable solutions.

How does Portfolio Tracker ensure data accuracy and reliability?

Portfolio Tracker ensures data accuracy and reliability through its unique use of distributed ledger technology and a breakthrough databot. It collects data from source with an immutable chain of provenance, meaning that every piece of data is backed by evidence of its origin. This allows users to trust that the data they receive is not only current but also verifiable.

Can Portfolio Tracker accommodate different types and sizes of companies?

Yes, Portfolio Tracker is designed to support companies of all sizes, from large enterprises to SMEs. It provides a golden source of normalised data that can be utilised across various sectors, enabling users to create actual, thematic, and virtual portfolios. Additionally, users can download raw data and reports to enhance their own analytical models, making it a flexible tool for diverse organisational needs.